2025

How Insur3Tech Helps Property Owners Keep Renters Insurance Profits In-House

If you’ve spent any time in multifamily circles lately, you’ve probably heard the same question floating around:

“I keep hearing about this type of insurance program, but how does it actually work?”

It’s a good question, and one we’ve been getting a lot recently.

So here’s the short version of how Insur3Tech works, and why so many real estate owners and operators are adopting it across their portfolios.

The Problem: Resident Insurance Dollars Are Leaving Your Portfolio

Every resident in your community is already paying for renter’s insurance.

But right now, that money flows directly to third-party insurance providers and carriers.

That means the profit generated by your residents through a mandatory insurance cost is going to someone else’s bottom line, not yours.

That’s a missed opportunity for every owner and investor focused on NOI optimization and portfolio growth.

The Solution: Keeping Those Dollars In-House

Insur3Tech changes that.

We help residential real estate owners, investors, and operators retain the full profit potential from resident insurance programs, while improving coverage compliance and simplifying the leasing experience for everyone involved.

Here’s how:

✅ Residents stay compliant through automated policy management.

✅ Property teams save time by eliminating manual COI tracking.

✅ Ownership keeps insurance revenue in-house, adding real NOI growth.

The best part? There are no added charges for residents, just increased income and efficiency for your portfolio.

Beyond Renters Insurance: Expanding Revenue Streams

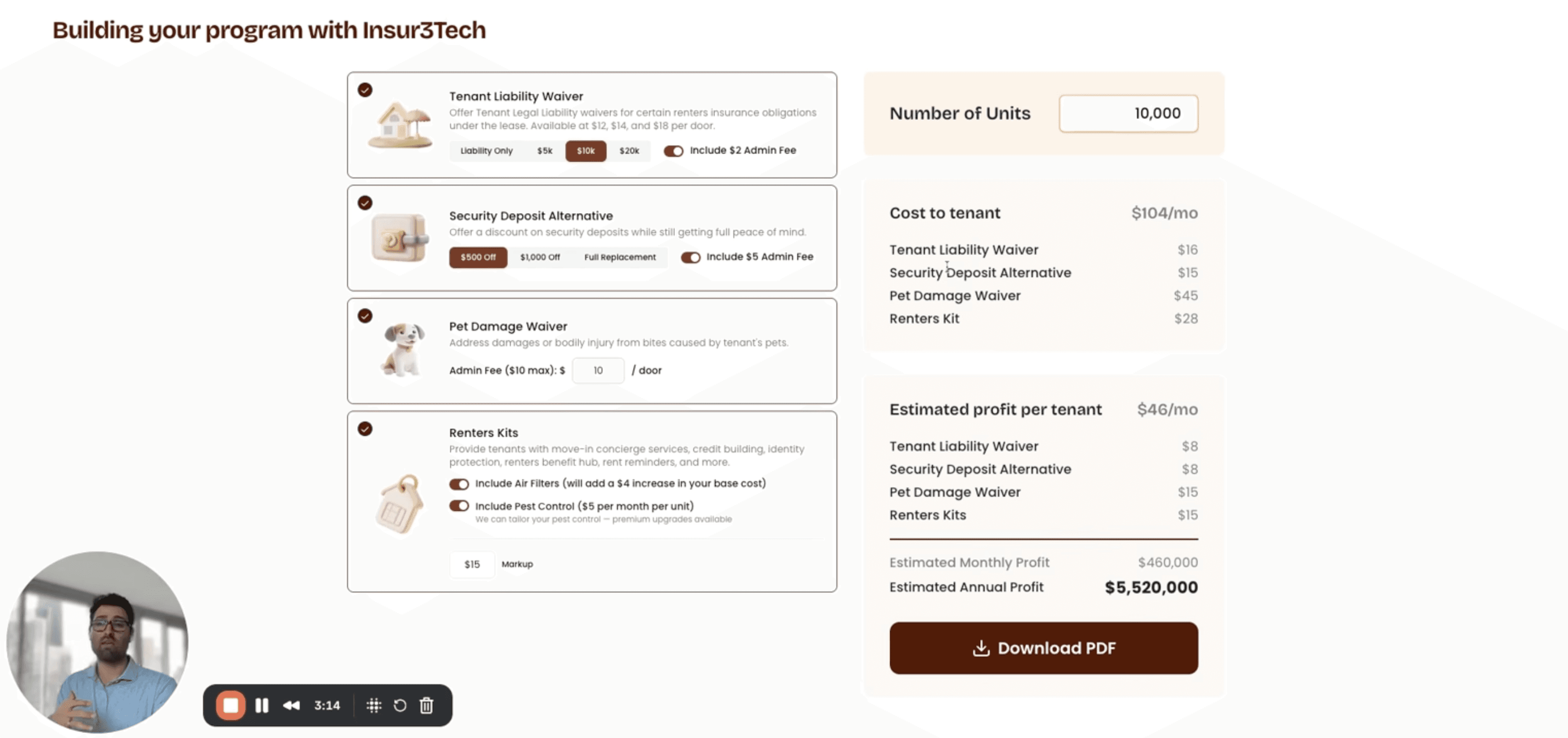

Insur3Tech’s platform isn’t limited to renters insurance. We also provide optional programs like:

Deposit alternatives that replace traditional cash deposits.

Pet damage liability waivers that keep both pets and property protected.

Resident value-add services, such as air filter delivery, designed to create small but consistent incremental revenue streams.

Each of these can be layered together and bundled as a kit, allowing you to stack ancillary income without increasing your team’s operational burden.

See the ROI for Your Portfolio

Curious what this looks like in real numbers? We can send you a custom ROI calculator showing exactly how much additional NOI your portfolio could be generating today by bringing these insurance programs in-house.

If you’d like to see your numbers, simply reach out and we’ll send over your tailored report.

The Bottom Line

The residential real estate industry is evolving fast, and the next wave of profit growth isn’t coming from higher rent or new fees.

It’s coming from owning the financial infrastructure behind your residents’ lease obligations.

With Insur3Tech, that transition is simple, seamless, and built for real estate professionals who are ready to take control of their own revenue.

Keep up with what matters.

Simple, useful ideas on real estate NOI, optimization, and growth shared on LinkedIN.