2025

It sounds optimistic, maybe even naïve, if you’ve been operating apartments since 2019. But the forces that caused premiums to explode are now creating something even more disruptive: real alternatives to traditional insurance.

And once operators experience those alternatives, the market will never fully go back.

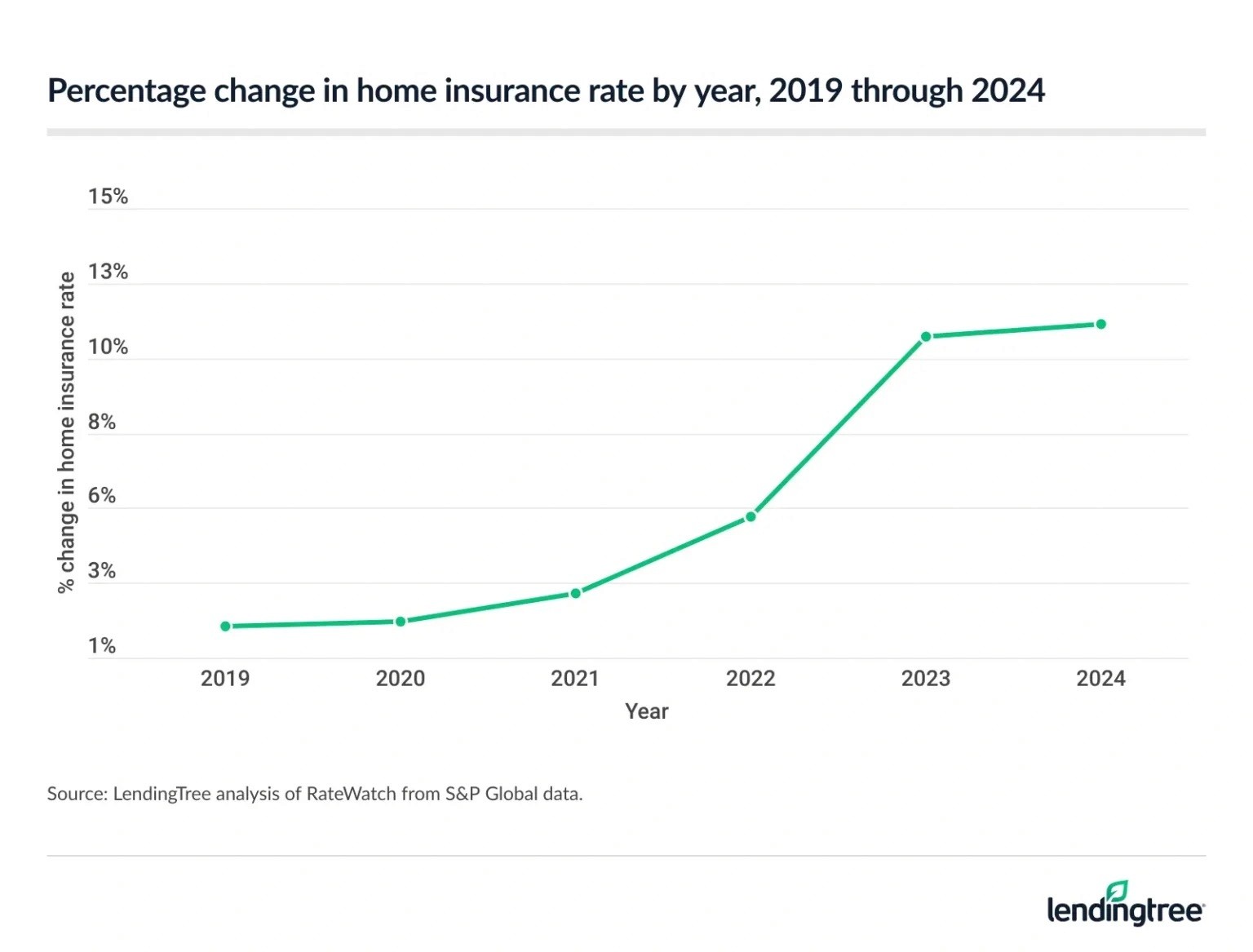

A Quick Look at How Bad Multifamily Insurance Got

Let’s anchor this in reality.

2019: ~$39 per unit per month

2024: ~$68 per unit per month nationally

Florida operators: $120–$150 per unit per month

That’s not inflation. That’s a structural failure.

For years, owners had no leverage. You paid what carriers demanded because the alternative was being uninsured or non-renewed.

But that extreme pricing created something carriers didn’t anticipate…

High Premiums Created the Perfect Conditions for Disruption

When insurance costs crossed a certain threshold, they stopped being “an expense” and became a business opportunity.

That’s when operators started seriously exploring:

Captive insurance options

Risk Retention Groups (RRGs)

Self-insurance programs for apartment owners

Resident insurance profit-sharing models

Platforms like Insur3Tech, where operators own the insurance company instead of renting it

Here’s the math that changed everything:

A 1,000-unit portfolio paying $800,000 per year in insurance doesn’t need a 10% savings to matter.

It needs structural change.

With alternative risk structures, that same operator can:

Cover claims internally

Control underwriting and loss incentives

Generate insurance income

Offset $300K–$400K+ of annual insurance expenses every year

At that point, insurance stops being a sunk cost, and it turns into a minor cost or eventually becomes NOI with models like Insur3Tech's.

Carriers Spent 2025 Watching Their Best Customers Leave

This is the part no one in the traditional insurance world likes to talk about.

Carriers raised rates aggressively to protect margins.

But in doing so, they:

Pushed disciplined operators out of pooled risk

Kept the riskiest assets on their books

Shrunk volume while increasing volatility

It’s the same dynamic landlords see when rents go too high:

Your best tenants leave

Retention drops

You’re left with worse risk and lower quality income

Insurance just runs on a 2–3 year lag, not a 6-month leasing cycle.

That’s why 2026 matters.

Why Traditional Carriers Can’t Compete — Even If Rates Drop

Yes, you’ll start seeing new language in 2026:

“Profit-sharing programs”

“Loss credits”

“Participating policies”

But here’s the hard truth:

Traditional insurance companies cannot structurally compete with captives or RRGs.

Why?

Because their incentives are misaligned.

They must:

Retain profits to pay shareholders

Protect carrier balance sheets

Socialize risk across unrelated portfolios

Captives and alternative insurance models flip this entirely:

The customers are the shareholders

Profits flow back to owners and operators

Clean properties directly benefit from good performance

Even if a carrier lowers your premium by 10–15%, it still can’t match:

Profit distributions

Long-term equity share

NOI generation from resident insurance

Control over underwriting and claims experience

Why This Shift Is Permanent

Once an operator:

Receives an annual insurance distribution

Sees insurance reduce net operating expenses

Uses resident insurance as a profit center

Stops subsidizing losses in other states and asset classes

…they never go back.

Lower premiums might slow adoption, but they won’t reverse it.

The industry crossed a line where insurance ownership now beats insurance purchasing. This is currently becoming a new industry trend, and eventually will be the standard.

The Real Question for 2026 Multifamily Operators

The question isn’t:

“Will insurance premiums go down from here?”

It’s:

“Who owns the insurance from here?”

Because in the next cycle:

Some operators will pay slightly less

Others will get paid

And that difference will decide which deals survive refinancing, and which don’t.

Keep up with what matters.

Simple, useful ideas on real estate NOI, optimization, and growth shared on LinkedIN.