2025

The Real Economics Behind Renters Insurance Premiums

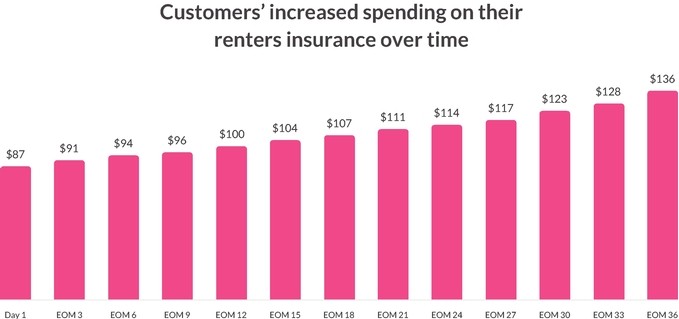

I asked a multifamily owner where their resident’s $125,000 in annual insurance premium actually goes. They had NO idea. Most don't.

Let me break it down for you. Here's what actually happens to that money:

Claims (loss ratio): ~$25,000-43,750 (20-35%).

This is what's used to pay when something goes wrong. Industry average for renters insurance is around 20-35%. So if they’re paying $180/unit annually, only $35-60 is earmarked for actual claims.

Operating expenses (expense ratio): ~$37,500-43,750 (30-45%).

This includes:

Agent commissions/admin fees (10-20% of the premium goes straight to the person who sold the policy).

Underwriting costs (salaries, office rent, IT systems).

Premium taxes and regulatory fees.

Administrative overhead.

Insurance profit: ~$25,000-62,500 (20-50%).

What's left over for the insurance company's profit margin and reserves.

If you do the math - Insurance companies measure this using the "combined ratio" - the sum of loss ratio + expense ratio.

Industry combined ratio averages 50-80%. That means insurance companies spend 50-80 cents of every dollar on claims and expenses. The remaining 20-50 cents? That's their underwriting profit.

The bottom line is pretty straightforward.

Insurance operates on “risk pooling”. Your premium doesn't sit in an account with your name on it - it goes into a pool with other policyholders. This allows the insurer to pay large claims that exceed what any single policyholder contributed, while earning interest.

Yes, it is just a contract that says: pay us X per month, and we'll pay you from this bank account if Y happens.

But technically it's actually: "I pay X, which joins a pool”.

”The pool pays everyone's claims, funds the operation, and maintains reserves required by law."

Most operators think insurance is too complex to understand, so they hand it off to an agent and hope for the best. But it's not complex. It's just a contract and a bank account with a 30-40% overhead attached. Once you understand that, you start asking different questions.

Like: Why are my residents paying someone else to hold their money and keep the returns?

Or: Why are my residents subsidizing other properties' when mine have a clean record?

And those are good questions to ask.

Keep up with what matters.

Simple, useful ideas on real estate NOI, optimization, and growth shared on LinkedIN.