2025

The Common Reaction: “That Sounds Too Good to Be True”

When I first explain Insur3Tech’s model to owners and property managers, the response is almost always the same:

“That sounds too good to be true.”

“It’s so simple, there has to be a catch…”

And honestly, I understand why.

For decades, the multifamily and single-family rental industries have been told that renters insurance only works one way, the way big traditional insurance carriers designed it to.

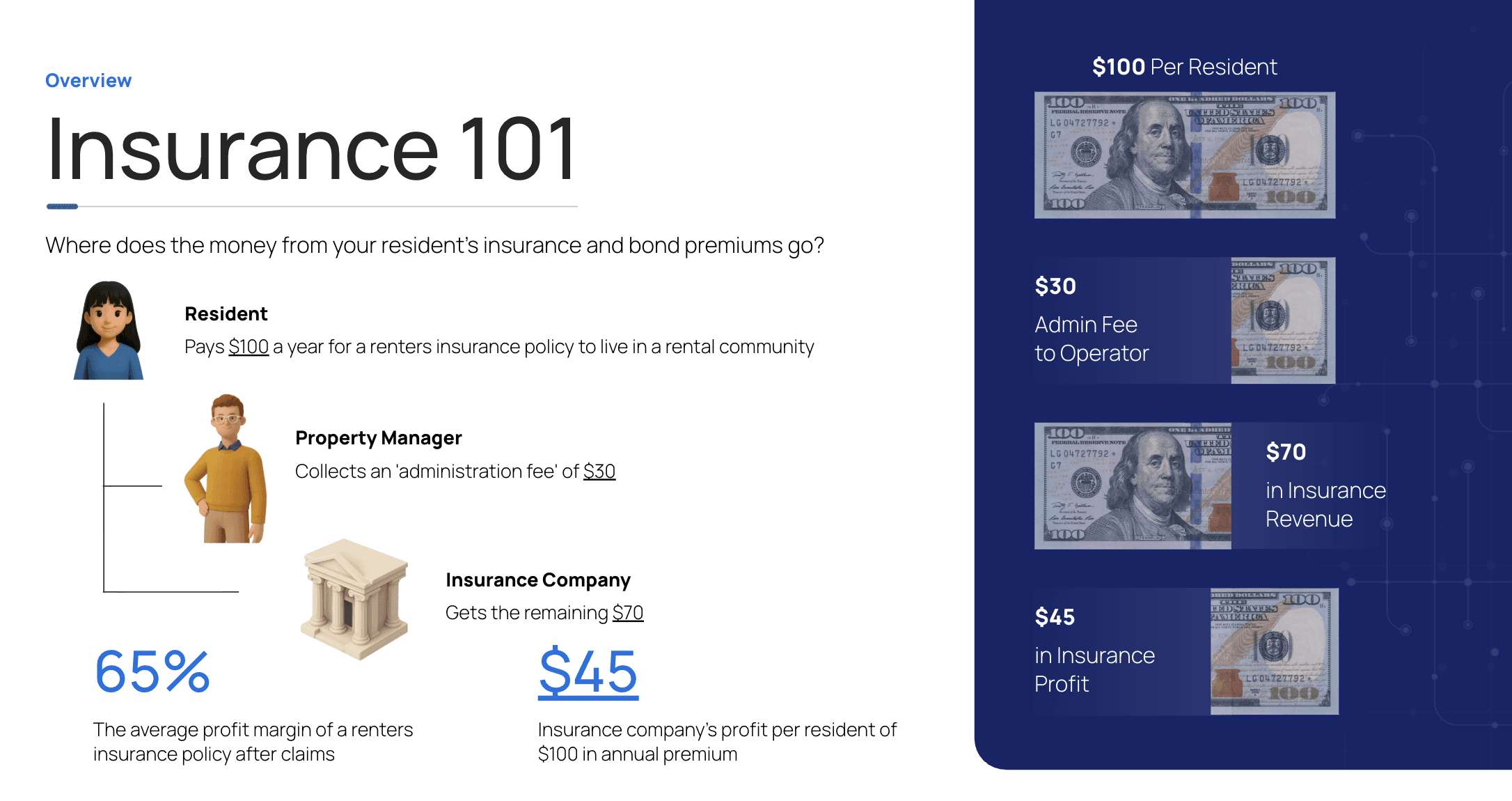

The Old Model: How Renters Insurance Has Always Worked

Here’s how the traditional structure looks today across most portfolios:

Residents pay $10–$20/month for coverage.

Owners and PMCs receive a small admin fee, typically $3–$5 per policy.

Carriers and third-party providers keep the rest, pocketing 60–70% of total premiums as pure profit.

It’s a model built to reward the carriers, not the owners or investors actually managing the risk on their properties.

The Insur3Tech Model: Flipping the Economics

Insur3Tech changes the equation entirely.

Instead of letting those premium profits disappear to a third-party carrier, our platform allows owners, property managers, and investors to retain both the underwriting profits and admin fees from their residents’ policies, while still providing the same (or better) coverage and compliance.

That means every dollar your residents are already paying for renters insurance starts working for you, not for someone else’s balance sheet.

Real Results: Higher NOI and Simpler Operations

Across portfolios using Insur3Tech today, the results speak for themselves:

📈 $200–$300 in additional NOI per unit annually

💰 Full control over pricing, profit margins, and claims management

⚙️ Seamless integration with existing leasing and PMS systems

And the best part? Residents don’t pay a cent more. They still meet their lease insurance requirements, the only difference is that the profit now flows back to ownership.

Why This Isn’t “Too Good to Be True”

Carriers have been quietly earning massive profits on renters insurance for years. The reason this model feels unbelievable is because it’s the first time owners and PMCs have had the ability (and now the platform) to claim what’s rightfully theirs.

The math has always been there; the transparency hasn’t. Insur3Tech simply brings it to light.

The Future of Renters Insurance Revenue

We’re witnessing a major shift in real estate operations:

Owners are realizing that every lease obligation can be turned into a revenue stream, from renters insurance to deposit alternatives, pet liability, and beyond.

It’s not just about collecting admin fees anymore. It’s about owning every part of the resident financial ecosystem and turning operational costs into recurring income.

What’s Next

Want to see what this could mean for your portfolio? Get a personalized ROI calculator and see exactly how much NOI you’re leaving on the table today.

Keep up with what matters.

Simple, useful ideas on real estate NOI, optimization, and growth shared on LinkedIN.