2025

If you’re a property manager, owner, or operator and you’re wondering why tours are up but leases are down, you’re not alone. Across the country, multifamily teams are reporting strong traffic, solid feedback, and competitive rents… yet conversion rates are quietly falling.

This isn’t a marketing problem.

It’s not a lead quality problem.

And it’s definitely not a leasing agent problem.

Most are saying it could be a fee structure problem.

The Real Reason Your Conversion Rate Is Dropping

Last week, I spoke with a property manager running a 300-unit community in a strong submarket.

Great location. Competitive rent at $1,800/month.

Leasing team is doing 20+ tours per week. Strong prospect feedback.

Yet their conversion rate has dropped from 70% to 55%.

On paper, nothing looked wrong.

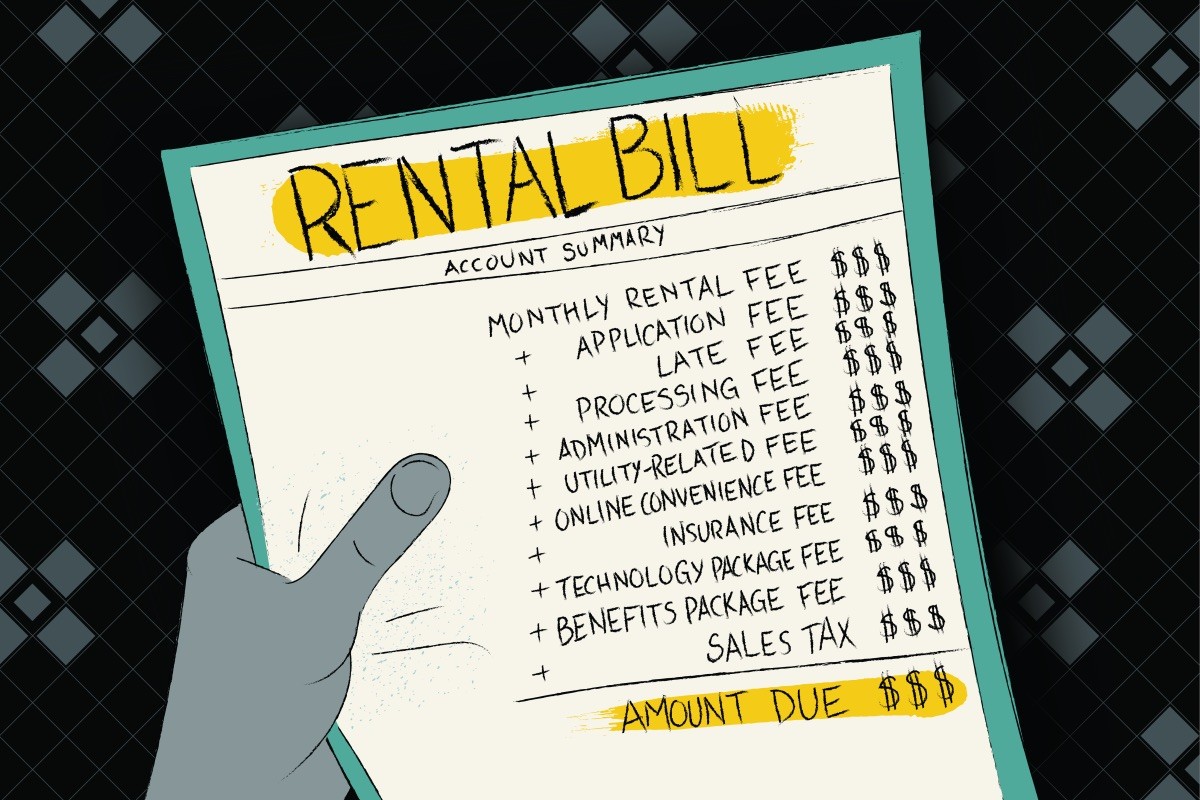

So we walked through what a resident actually sees at lease signing:

Security deposit: $500

Admin fee: $300

Pet deposit: $300

Pet rent: $50/month

Pest control: $20/month

Water/sewer billing: $85/month

That “$1,800/month apartment” is really:

$2,600 upfront move-in cost

$1,955/month effective rent

And here’s the problem:

From the resident’s perspective, every single one of those fees provides no real value to them.

Why Residents Are Walking (Even When They Like the Property)

Let’s look at this through the renter’s lens.

The $500 deposit? Locked in escrow. Maybe they get part of it back. Maybe they don’t.

The $300 admin fee? Invisible. No benefit. No service.

The $300 pet deposit + $50/month pet rent? Doesn’t protect their belongings. Doesn’t protect them from liability. Just a fee to cover damage to the property, not the resident.

The utility markups and amenity fees? Mandatory. No opt-out. No added protection.

So the resident is doing the math in real time:

“I’m paying $150+ a month in extra fees and getting nothing in return except permission to live here.”

Then they tour the property down the street.

Same rent. Similar unit.

But that property's lease shows:

Deposit alternative: $30/month instead of $500 upfront

Pet liability coverage: $25/month instead of $300 deposit + $50/month pet rent

Pest control: $20/month

Water/sewer billing: $85/month

Now the numbers look like this:

Move-in cost: $1,830 instead of $2,600

Monthly cost: $1,960 instead of $1,955

But the resident is actually sees the value in being covered and protected

Guess which lease gets signed.

It’s Not “Lost to Competition.” It’s Lost to Bad Economics.

Most PMs mark this as “lost to competition.”

But it’s not competition.

It’s value mismatch.

Residents aren’t rejecting your property.

They’re rejecting a fee stack that feels extractive, not protective.

They’re paying:

Admin fees

Pet fees

Utility markups

Amenity fees

Deposits

…and receiving no tangible benefit in return.

That $155/month in ancillary fees?

That’s $1,800 per year that feels like it disappears into a black hole.

From the resident’s perspective, it’s obvious:

One property is trying to help them.

The other is trying to monetize them.

And residents are voting with their applications.

The Bigger Problem: Fee Stacking Without Value Creation

This is the quiet crisis in multifamily right now.

Operators have layered fees without rethinking whether those fees actually create value for the resident.

It’s 4–5 layers of profit extraction with almost zero perceived benefit.

That’s not sustainable.

Not in a market where:

Rent growth is slowing

Consumers are stretched

And competing properties are getting smarter with resident-friendly programs

Why This Matters for NOI and Occupancy

Here’s the part most owners miss:

Bad fee structures don’t just hurt resident experience. They directly hurt NOI.

Lower conversion rates =

More vacancy

More concessions

More marketing spend

More pressure on rent

All because the deal dies at the finish line over move-in friction.

Meanwhile, properties that:

Offer deposit alternatives

Bundle insurance and protection products

Replace punitive fees with value-based programs

…are closing faster, leasing easier, and creating stickier residents.

The Shift That’s Already Happening

The smartest operators are moving away from:

Pure deposits

Flat pet rent

Admin-heavy fee stacks

And toward:

Deposit alternatives

Resident insurance programs

Pet liability coverage

Value-based ancillary revenue

Why?

Because residents will pay for protection.

They won’t pay for permission.

The Bottom Line

Leasing isn’t getting harder because your team is worse.

It’s getting harder because residents are finally seeing the math.

And when they do, they’re choosing the property that:

Costs less upfront

Feels fairer monthly

And actually gives them something for their money

If your tours are strong but your conversions are slipping, don’t look at your leasing agents.

Look at your fee stack.

Because right now, in multifamily, value wins. Fees lose.

Keep up with what matters.

Simple, useful ideas on real estate NOI, optimization, and growth shared on LinkedIN.