2025

The Real Estate Industry Shake-Up: A Crumbling System, The Old Model

"Let’s be honest, the traditional renters insurance model is breaking down."

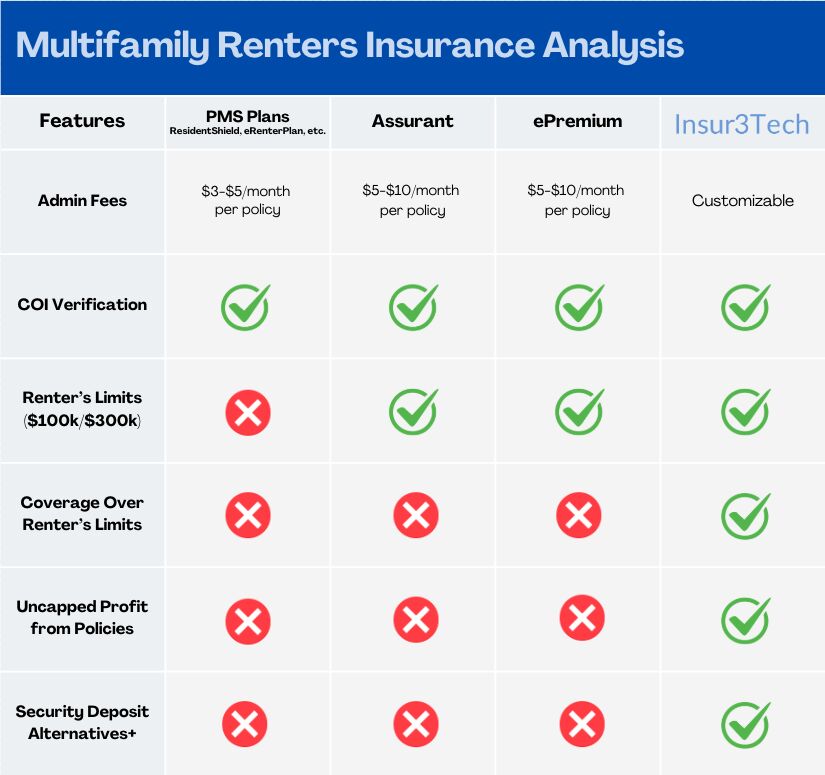

For years, major providers like Assurant, ePremium, and PMS-linked programs (ResidentShield, eRenterPlan, etc.) have operated under one rule: they keep the profits, while owners and operators collect the scraps.

But with platforms like Insur3Tech, that dynamic is changing fast. Owners and investors are finally realizing they can own the profit from their residents’ insurance programs instead of giving it away to third-party carriers.

And that’s why these legacy providers are panicking.

What’s Happening Behind the Scenes

In the past few months, many operators have shared what their current providers are doing to keep them from switching. Here’s what we’re hearing across the industry:

⚠️ Cash “advances” to lock you in:

Some providers are offering short-term cash payments or incentives to keep you signed for another year, hoping you won’t look too closely at the long-term profit you’re giving up.

⚠️ Rebranding the same model:

Others are pitching “new” or “innovative” products (like force-placed coverage) to make it seem like they’ve evolved. But behind the curtain, the economics remain unchanged. They still keep all the underwriting profit.

⚠️ Leaning on legacy relationships:

Many are using their brand name or long history in the industry to create doubt, saying things like “It’s too good to be true” or “It’s been working this way for years, why change it now?”

These are not signs of strength. They’re signs of a market in defensive mode, one that knows its traditional profit centers are slipping away.

The Truth About Renters Insurance Economics

Here’s the hard truth most owners never see:

Every year, your residents’ renters insurance premiums generate tens or even hundreds of thousands in underwriting profit for carriers.

Yet owners and operators might only receive a small admin fee of a few dollars per policy.

That’s like renting out your property and letting someone else collect the rent.

With Insur3Tech, all that changes: Our platform allows owners, PMCs, and investors to retain both the underwriting profit and admin fees, turning renters insurance from a passive requirement into an active revenue stream, all while improving compliance and simplifying operations.

Why the Industry Is Shifting

This isn’t about replacing one provider with another, it’s about rewriting the economics of the whole product itself.

As the real estate industry evolves, owners and investors are recognizing that every lease obligation can become an owned revenue channel. Renters insurance, deposit alternatives, pet liability, these aren’t side programs anymore. They’re part of the new financial core of property management.

Providers that fail to adapt are losing relevance fast. The ones who act now, i.e. those who adopt models like Insur3Tech — are positioning themselves to own every dollar of profit their portfolios generate.

The Bottom Line

If your current provider is fighting to keep you with cash incentives, vague promises, or fear tactics, it’s not because they care about your success.

It’s because they’re protecting their margins, the same margins that could be yours.

Insur3Tech is flipping that equation from Day 1.

Your residents keep their coverage. Your teams simplify operations.

And you finally start earning what’s been yours all along.

Ready to see how much profit your portfolio is generating for someone else?

📊 Get a free ROI calculator or COI audit today to see your real numbers.

The old model is collapsing, make sure you’re on the right side of the shift.

Keep up with what matters.

Simple, useful ideas on real estate NOI, optimization, and growth shared on LinkedIN.